Construction industry groups are battling to fend off a possible resurfacing of proposals to make deep cuts in the federal gasoline and diesel taxes and “devolve” to the states more responsibilities for the federally aided highway program.

The last big devolution proposal was the Transportation Empowerment Act, which Sen. Mike Lee (R-Utah) and Rep. Tom Graves (R-Ga.) introduced in 2013. The proposal, backed by conservative groups such as Heritage Action for America, sought to phase down the 18.4¢-per-gallon federal gas tax over five years, to just 3.7¢, and cut the 24.4¢ diesel tax to 5¢. When the bill was introduced, Graves contended that it would "streamline the highway program, allowing more projects to be completed at a lower cost" by each state.

Last July, Lee tried to attach the devolution bill to a stopgap measure to reauthorize the highway and transit programs. But the Senate rejected the amendment, 69-28.

The measure has yet to reemerge in the current Congress. But with the surface-transportation authorization due to expire on May 31, a collection of industry groups is pushing to make sure the devolution proposal doesn't come back. The Transportation Construction Coalition, which includes the American Road & Transportation Builders Association, the Associated General Contractors of America, three labor unions and 26 other groups, argues in a March 16 report that, if the Lee-Graves plan were enacted, states would face severe consequences.

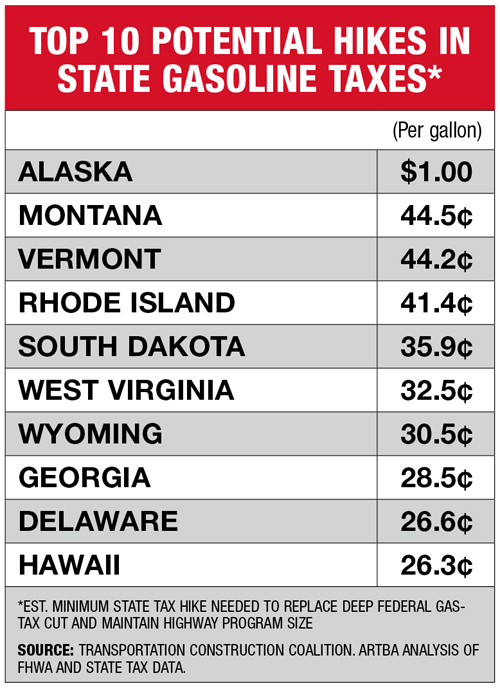

The coalition says if the devolution proposal's federal fuels-tax cuts were to become a reality—and states wanted to keep their highway programs at their current funding levels—states would need a total of $30 billion to fill the gap. If states used fuels taxes to cover the shortfall, they would have to raise their gasoline levies by an average of 22.8¢ per gallon and diesel taxes by 23.9¢, the report says.

Anti-devolutionists have prominent congressional allies. For example, House Transportation and Infrastructure Committee Chairman Bill Shuster (R-Pa.) and Senate Environment and Public Works Committee Chairman James Inhofe (R-Okla.)—a former devolution advocate— strongly support maintaining a major federal role in highways. Also on their side is North Carolina's Republican governor, Pat McCrory, who told Shuster's committee at a March 17 hearing that the devolution proposal would be "catastrophic" for his state and many others.

The House panel's top Democrat, Peter DeFazio (Ore.), is another devolution foe. He said, "I just want to put a nail in the coffin, stake through the heart and garlic around the neck."

In 2013, six states raised or reformed their gasoline taxes, and, last year, two more did so, Carl Davis, Institute on Taxation and Economic Policy senior policy analyst, said in a Jan. 29 blog post.

Wyoming increased its gas tax in 2013.But John Cox, Wyoming Dept. of Transportation director, said at the House hearing that those state gas-tax hikes are a supplement to, not a substitute for, the federal program.