Survey Technology Firms Deploy Their Own Drones

Consumer-level unmanned aerial vehicles (UAVs) can be purchased off the shelf and be up in the air as soon as the batteries are charged, but the data-driven world of construction surveying often demands something a bit more robust. In anticipation of up- coming regulations from the Federal Aviation Administration, surveying and mapping equipment firms are making big investments in UAVs. Many companies are already offering their own drones that are tailored to the needs of construction surveying.

"Anybody can run to a hobby shop, get a quadcopter [UAV] and throw a GoPro [camera] on it. But that's just a photo," says Bryan Baker, Leica Geo- systems' NAFTA region sales manager for unmanned-aircraft systems. "People in construction are going to want this integrated into their CAD systems, their building information modeling, their construction design tools. You're not going to get that from a hobby shop." Leica now offers two unmanned aircraft systems: the high-end Dragon 35 syncopter from original equipment manufacturer (OEM) Swissdrones, Sevelen, Switzerland, and the more compact, less pricey Aibot A6 hexacopter, made by Aibotix, a Kassel, Germany-based drone maker Leica acquired in early 2014.

In recent years, many of the biggest manufacturers of construction surveying equipment have acquired or made OEM deals with UAV manufacturers, rather than develop their own drones. "Getting [FAA special certification for a UAV] is a very expensive and time-consuming process for us," says Baker. "If the FAA ends up requiring certification for use, you're going to see about 90% of UAV companies go away."

Not looking to compete with the drone makers that target consumers and, particularly, photographers, survey technology firms are pitching their own premium-priced UAVs to the construction, mining and agriculture markets. These machines often boast more features than the standard "waypoint navigation with an onboard camera" offered by entry-level UAVs. In some cases, these higher-end machines can perform much of the work done in traditional aerial surveying.

"We're already able to use UAVs in basic surveying: photogrammetry, volumetrics for earthmoving. For the construction process, we can now provide stakeholders with updates on the project—not just photos, but measurements taken from the aircraft—to see if it's all up to spec," says Baker. Photogrammetry, the process of using aerial photography and location data to make exact measurements, requires a level of precision that most lower-cost drones can't meet, he says.

"I don't believe UAVs will replace surveying equipment, but they will certainly narrow the scope of what you'll need a total station or other ground-based equipment for," says Todd Steiner, imaging business marketing director for Trimble's geospatial division. "It is changing the workflow. In the past, you might hire a survey company to do a topographic survey of the land. Now, you can take out a UAV with some other survey technology and do the initial planning and survey in a couple of hours—versus days or weeks using traditional technology—and what you end up with is a much denser info set," he says.

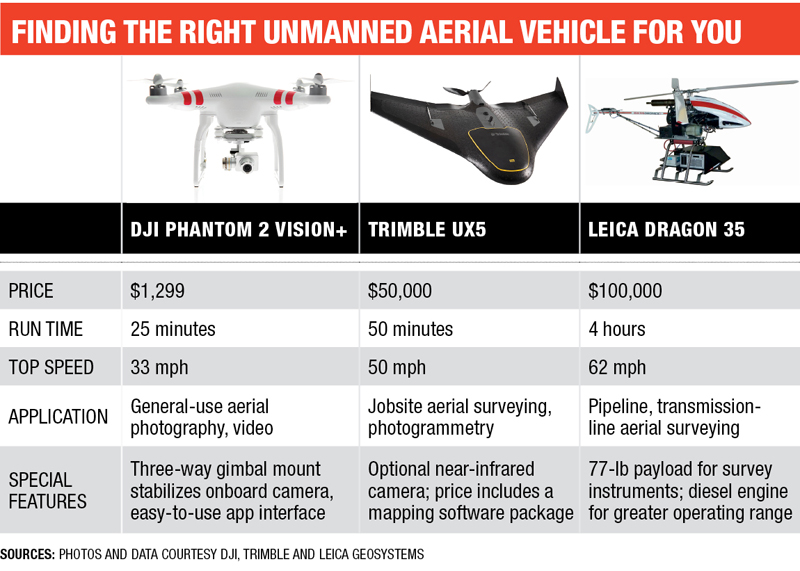

Layout software already exists to incorporate ground-based survey data into the design and construction workflow. According to Steiner, proper integration into these platforms is one capability the $50,000 Trimble UX5 drone has that is lacking in, for example, the $1,299 DJI Phantom 2 Vision+.

Trimble acquired Gent, Belgium-based drone maker Gatewing in 2012 and has worked to integrate Gatewing's UAVs into its survey and construction software platforms. The UX5 is bundled with Trimble Business Center software and includes photogrammetry and UAV flight-planning modules. "It offers us a nice way to create deliverables," says Steiner. "Rather than a UAV company saying, 'Here's your UAV,' we bring the whole solution integrated into ground-based surveying and photogrammetry software."

By performing much of the work of a third-party aerial surveyor, UAVs offer gains in productivity and cost savings that more than justify the cost, says Dave Henderson, director of geospatial solutions at Topcon Positioning Systems. "In a 55-minute flight you can survey 180 acres. Ask yourself: What other method can a contractor use to get all that?" he says.

Topcon's UAV entry is the Sirius, a fixed-wing, propeller-driven drone made by MAVinci, a drone maker based in St. Leon-Rot, Germany. The basic $42,000 model works with ground reference points to tag image locations precisely. The $53,000 Sirius Pro has onboard real-time kinematics (RTK), which eliminates the need for multiple ground-reference points when obtaining highly accurate map data. "What these [UAVs] offer is another tool for contractors to get data as needed on a continuous basis, based on the demands of the project," says Henderson. "It's a different piece of technology for the same deliverable."

Some survey technology firms are getting into drones on their own terms. Javad Ashjaee's firm, JAVAD, is best known for its global navigation satellite system (GNSS) receivers and base stations. However, when eight rotors are attached on four arms and cameras are fixed to a base station, it becomes a survey UAV. "Other people just bought some toys and put a GPS on it. We added wings to our survey unit," Ashjaee says. "It is a flying GPS survey unit."

The Triumph F-1 is designed to get a GPS instruments package up to height and then take the same precise measurements as it can on the ground. "Ideally, it will be used for small-scale surveying of buildings or roofs," says Ashjaee. The drone has four 45°-mounted cameras for documentation and a single high-precision, downward-facing camera for photogrammetry. JAVAD plans to launch the Triumph F-1 in the first quarter of 2015.

While there are immediate benefits for using a lower-cost UAV to get aerial views on the cheap, survey tech firms are betting the construction industry is more interested in rich data as more elaborate sensors are added to drones, says Trimble's Steiner. "We're going to be able to provide a deeper kind of deliverable than construction uses today. Eventually, we'll be comparing a live 2D or 3D scan to 3D models in real time."