Q4 Cost Report: 'Deja Vu' All Over Again

Trying to predict when the industry recovery will kick in, construction economists can only agree that things will get better, just not next year. While the optimists are hoping healthy markets will return in 2013, the pessimists are hoping for 2014 or even 2015 (see ENR 11/14/11 p. 10). Next year's expected weak demand underlies ENR's forecast for its cost indexes in 2012. Unemployment will continue to keep labor costs in check, and neither lumber, steel nor cement prices are expected to make much headway.

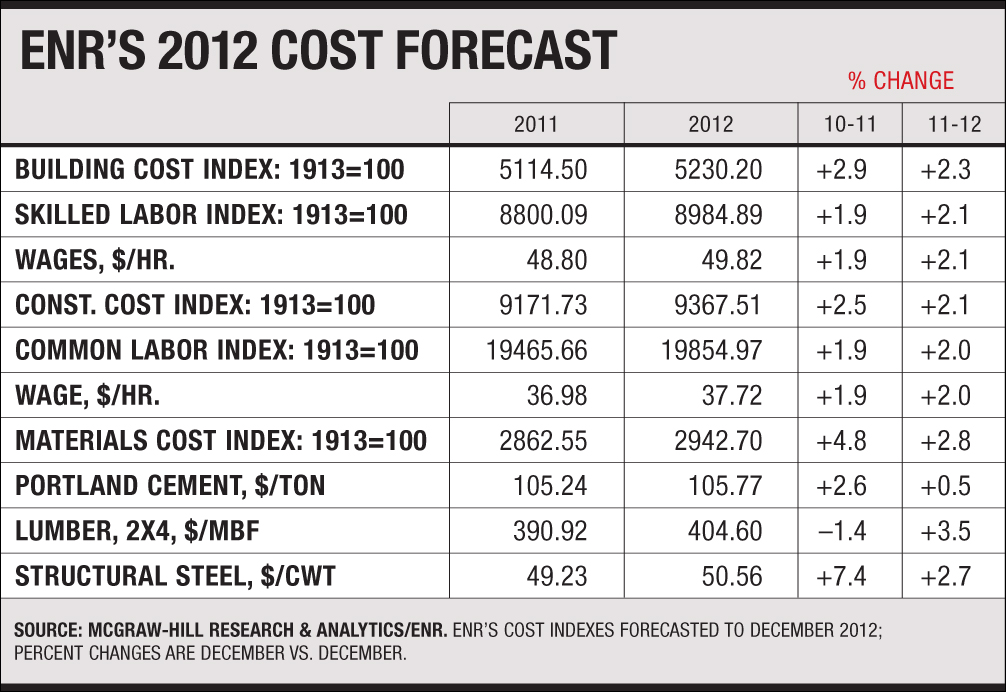

With that backdrop, ENR is forecasting a 2.1% increase in its Construction Cost Index in 2012, following this year's 2.5% increase. The forecast for the Building Cost Index is for it to increase 2.3% next year, after increasing 2.9% in 2011.

A year ago, ENR predicted a 2.0% increase in the CCI and only a 1.3% increase in the BCI. A surprising surge in steel prices during the first half of 2011 gave costs an unexpected nudge upward. However, inflation did hold to the general forecast of easing from 2010's annual increase of 3.6% for both the CCI and BCI.

The accuracy of ENR's forecast is heavily influenced by union-wage settlements, which account for 81% of the CCI and 66% of the BCI. The lackluster economic and construction market forecasts for 2012 leave little hope that labor wages and benefits will improve much beyond the 1.9% annual increase recorded by ENR this year for its skilled and common-labor cost indexes.

Union craft labor faces another year of historically low wage increases following its 2011 negotiations. Through the end of December, first-year wage and benefit settlements remain flat, according to Washington, D.C.-based Construction Labor Research Council. For 2011, CLRC reports that increases averaged just 1.7%. "In the bargaining world, we've bottomed out," says Carey Peters, executive director of CLRC. "These are historically low and probably won't go lower on average."

With increases at such low levels, both sides of the negotiations appear hesitant to commit to multiyear agreements, Peters notes. In 2011, roughly 60% of all settlement terms have been for one year. "Neither management nor labor wants to become attached to anything greater than a year," he adds, noting that, historically, around 40% of terms are for one year.

Funding pensions continues to be a focus of many settlement packages. Peters says half of all increases in total packages are dedicated to pensions. Over the last decade, fringes have grown to 35% from 27% of packages, according to CLRC.

ENR expects this trend to continue and is forecasting for next year a 2.1% increase in the skilled-labor component of the BCI and a 2.0% increase the labor component of the CCI.

Structural-steel prices defied a down market this year as higher scrap costs pushed the average mill price for structural steel up 18% over 2010's average price, says John Anton, steel analyst for IHS Global Insight, Washington, D.C. Most of the gain came in the first half of the year as structural-steel prices peaked at $888 a ton in the second quarter.

Steel price slid from that peak, and by year's end they should be back down to $810 a ton, Anton estimates. He predicts that decline will continue through 2012, with structural-steel mill prices falling another 6.3%, to $759 a ton.

Not all of the higher mill prices were passed on to contractors, with fabricators absorbing some of the increase. ENR's contractor price for structural steel increased 7.4% this year. Steel makes up 23% of the BCI and 13% of the CCI. However, ENR believes some of the higher mill prices are yet to impact its indexes and is forecasting the steel components of the BCI and CCI to increase another 2.7% next year.

"Lumber prices have bottomed out, and they are not bouncing back," says Robert Berg, chief economist with the lumber forecasting firm RISI, Bedford, Mass. RISI's composite lumber price was $272 per thousand board-feet (mbf) a year ago and is currently at $265. Berg predicts that after some seasonal swings, it will end next year back at $270. That is about as flat a trend as the traditionally volatile lumber prices can muster.

The lumber industry is operating at below 70% capacity—and that's after shutting down about 130 mills, says Berg. The reduced overall industry capacity fell to about 72.5 billion bd-ft now from 82.3 billion bd-ft in 2006, according to RISI. But demand has fallen even sharper, dropping from a peak of 74.5 billion bd-ft in 2005 to 45.5 billion bd-ft in 2009, where it has stayed. Berg forecasts that lumber demand next year will be only 48 billion bd-ft. With exports dropping off, there is nothing to drive prices, he says. ENR is forecasting the lumber components of its indexes to increase 3.5% next year, after falling 1.4% in 2011.

Cement prices are in the same boat, going nowhere. ENR is forecasting the cement component of its indexes to increase just 0.5% next year, following this year's 2.6% increase. The cement industry is operating at just below 60% capacity, says Ed Sullivan, chief economist with the Portland Cement Association, Skokie, Ill. That capacity utilization rate comes after closing 18 plants, eight permanently. PCA predicts that portland-cement consumption will increase just 0.5% next year, to 71.3 million metric tonnes.