In just a few years, America has become the low-cost producer of a major energy source—natural gas—and the long-term implications could be a game changer for some materials. New drilling technology has dramatically increased the production of oil and gas from North America's abundant shale resources. Furthermore, producers are now "flaring off" fewer wells to capture the gas for productive uses.

This trend already is spurring construction in the powerplant sector: Utilities are switching to combined-cycle gas plants, while pushing coal-fired plants to the point of extinction.

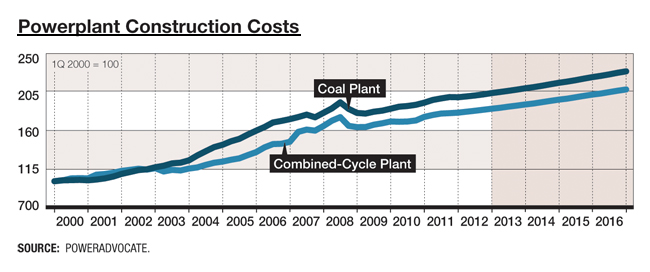

"The reality is that there are not many new coal plants being built," says Sean Riley, who compiles cost indexes for powerplant construction for PowerAdvocate, Boston. Those indexes show costs are escalating faster for a coal-fired plant than for a combined-cycle gas plant, primarily due to the expensive equipment required for emissions control on a coal-fired plant, Riley says. He estimates the final cost of energy from a coal plant is 2.5 times higher than the cost of a gas plant.

Perhaps more important is the impact of low-priced natural gas on industrial markets, which use it as a feedstock for many manufacturing products, such as plastic products. This pattern, in turn, influences construction costs. As a low-cost producer of natural gas, the U.S. could regain its prominence in the global industrial markets.

There are already early signs of this. Through the first four months of this year, the dollar value of construction put-in-place tracked by the U.S. Dept. of Commerce was up 20% for powerplant work and up 39% for manufacturing construction compared to the same period of a year ago. These two markets are growing faster by far than other construction sectors.

The nascent natural-gas filling-station sector, while small, may be a leading indicator. Chesapeake Energy, based in Oklahoma City, is building 250 natural-gas filling stations, mostly add-ons to existing stations. This trend will help provide basic infrastructure for a new breed of natural-gas pickup trucks that Ford and General Motors are introducing. Other sectors are feeling the influence of gas.

"Falling natural-gas prices will have virtually no impact on steel prices in the short term. However, in the long term, the impact could be huge," says John Anton, steel analyst for forecasting firm IHS Global Insight, Washington, D.C.

Anticipated lower electricity prices won't be the only long-term impact, Anton says. The cost of scrap metal, the primary ingredient in most construction steel, is becoming more problematic, and producers are increasingly looking to "reduced direct iron" to supply their mills, he says. That process depends heavily on natural gas. Lower natural-gas prices make the switch more attractive as scrap prices increase. The changeover could be five to 20 years down the road, but it is a trend to keep your eye on, says Anton.

Only about 4% of portland cement production currently is produced using natural gas, says Ed Sullivan, chief economist of the Portland Cement Association, Skokie, Ill. With capacity utilization so low, few cement producers are thinking of expansion, says Sullivan. But the consensus in the industry seems to be that when expansion becomes necessary, natural gas will become the energy source of choice, he says.

"I don't expect to see a big impact on material prices as a result of the lower cost of natural gas," says Robert Martin, a Global Insight economist who tracks construction materials. "Plastics and chemicals will see an immediate impact, but for most other materials the change will be indirect and take decades," he says. "Those types of pass-through savings take generations," Martin adds.