Companies

Viewpoint by Marty Garza, VP-Bartlett Cocke General Contractors

Let's Join Forces to Make Construction Education the Best

Why the right university accreditation matters to me—and it should to you too!

Read More

4Q Cost Report: Fleet Sales to Stall Out in 2016

Federal transportation bill will help support only modest equipment activity, forecasters say

Read More

4Q Cost Report: Inflation Makes Small Gains Despite Recovery

Lumber prices will rebound to 2014 levels, while steel prices post steep declines

Read More

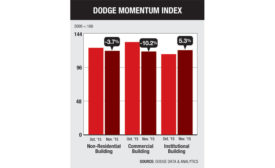

4Q Cost Report: Strong Market Raises Worries Over What the Future Holds

With most markets growing steadily, firms now are wondering how long this can last

Read More

Going Against the Grain: Mass Timber Skyscrapers

‘Timber huggers’ are taking action to change conventional wisdom that tall wood buildings are inferior

Read More

The latest news and information

#1 Source for Construction News, Data, Rankings, Analysis, and Commentary

JOIN ENR UNLIMITEDCopyright ©2025. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing