Home » Keywords: » Offshore wind energy construction

Items Tagged with 'Offshore wind energy construction'

ARTICLES

Clean Energy Construction

Clean Energy Construction

Massachusetts $300M Offshore Wind Terminal Starts as Key Sector Boost

Crowley Maritime is port facility CM with D.W. White and J.F. White named contractors and AECOM as designer

Read More

Clean Energy Construction

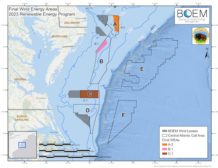

US Offshore Wind Gets Atlantic, Gulf Pushes Amid More Sector Cost Tumult

Read MoreClean Energy Construction

Wind Turbine Giant Siemens Will Build $200M Va. Production Plant

Read MoreThe latest news and information

#1 Source for Construction News, Data, Rankings, Analysis, and Commentary

JOIN ENR UNLIMITEDCopyright ©2025. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing