ENR MidAtlantic 2024 Specialty Contractor of the Year

Market Remains Steady for Region’s Specialty Firms

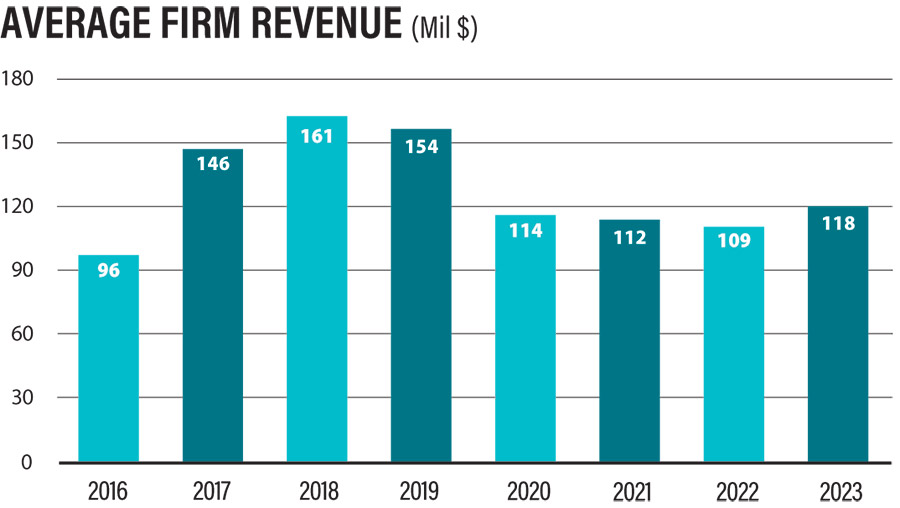

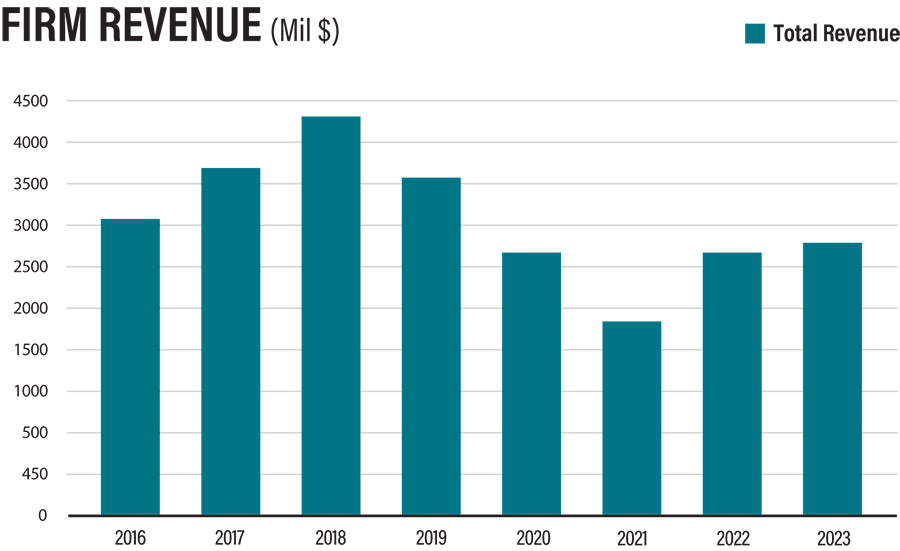

The 24 firms ranked on the 2024 ENR MidAtlantic Top Specialty Contractors list posted a 4% increase in 2023 revenue compared with 2022

Rosendin Electric Inc., ranked No. 3 on the ENR MidAtlantic Top Specialty Contractors list, is building a confidential data center project in Northern Virginia.

Photo by Ke’Shaun Whitehead, courtesy Rosendin Electric Inc.

Related Link:

ENR MidAtlantic 2024 Top Specialty Contractors

If some MidAtlantic specialty contractors might have felt they were finally stepping off a roller coaster of rising interest rates, supply chain interruptions and climbing material and labor costs heading into 2024, regional revenue reported on the 2024 ENR MidAtlantic Top Specialty Contractor ranking may have justified that impression.

The top 10 companies on this year’s ranking—based on 2023 data—reported a combined $2.21 billion in regional revenue, a 5.23% increase from $2.10 billion in 2022. Last year’s top 10 total represented a 16.02% increase from the $1.81 billion reported by the top 10 firms on the previous year’s ranking.

Tony Esteve, business development manager at Rosendin Electric, says the MidAtlantic market overall remains strong as “mission critical/data center construction continues to offer the most significant opportunities in the MidAtlantic. The growth of AI, data analytics and the demand for cloud resources are driving the continued development of this sector.”

Chart by ENR

Rosendin was ranked No. 3 on this year’s survey with $338.5 million in regional revenue, a 19.54% revenue decrease from last year, when the firm topped the list with $420.68 million in revenue. Esteve notes that the region’s commercial office sector “remains depressed,” but he adds, “we’ve seen opportunities to transition from commercial to residential use in this space.”

Esteve also says the need for electrical work is especially high in the region “as demand for skilled tradespeople and project leadership—foremen and project managers—exceeds the labor supply.”

And while some firms might feel looming uncertainty heading into a second Trump administration, some company leaders believe the incoming administration will improve working conditions in the region and beyond.

“The Trump administration’s focus on tax incentives, deregulation and public-private partnerships is expected to accelerate project approvals and reduce costs,” says Robert Pelham, chief executive at Extreme Steel, No. 20 on this year’s list with $39.56 million in regional revenue. “The bipartisan Infrastructure and Jobs Act already supports our growth, and we are well-positioned to capitalize on federal and state investments in infrastructure.”

Extreme Steel Inc., ranked No. 20 on the ENR MidAtlantic’s Specialty Contractor ranking, worked on the National Air and Space Museum, successfully erecting and dismantling five phases of temporary roof structures to enable the safe removal and replacement of skylights.

Photo by Charles Mull, courtesy Extreme Steel Inc.

Steady Growth

Overall, the 24 firms on this year’s list combined to report $2.85 billion in revenue in a region that includes Delaware, Maryland, Pennsylvania, Virginia, West Virginia and the District of Columbia. The overall total is a 4.01% increase from the $2.74 billion posted by the top 24 firms on last year’s ranking.

“The Trump administration’s focus on tax incentives, deregulation and public-private partnerships is expected to accelerate project approvals and reduce costs.”

—Robert Pelham, CEO, Extreme Steel

While Rosendin Electric Inc. slipped two spots in the rankings this year to No. 3, Comfort Systems USA returned to the top slot after a year’s hiatus. The firm reported $424.34 million in regional revenue, a 5.2% increase from last year, when the firm finished second with $403.39 million in regional revenue.

The Houston-based firm also topped the mechanical and plumbing segmented ranking. All of its regional revenue was reported in that sector. Overall, the seven firms reporting work in the mechanical/plumbing sector combined to collect $1.12 billion in revenue, the same total as the top seven firms reporting mechanical/plumbing work last year.

Comfort Systems also performed $410.83 million worth of work in Virginia, up 5.8% from the $388.33 million it performed in Virginia the previous year. Overall, 14 firms on this year’s ranking recorded a combined $1.05 billion worth of work in the state, compared with $1.2 billion performed by 13 firms performing work in Virginia represented on last year’s ranking.

Chart by ENR

Strong District

The District of Columbia saw a 6.45% increase in work on this year’s survey with $99 million reported by seven firms, up from the $93 million in work done by seven firms on last year’s survey.

That work included Extreme Steel’s efforts on the National Air and Space Museum, where it erected and dismantled five phases of temporary roof structures to enable the removal and replacement of skylights. With long-span roof trusses reaching approximately 120 ft by 150 ft, the project required intricate rigging, custom plate assemblies with topside welding and seamless integration with the existing structure.

“Our team meticulously installed temporary structural steel and tarps while coordinating with precision to protect invaluable NASM artifacts below,” says Pelham, the firm’s CEO.

Extreme Steel, which recently acquired Superior Iron Works, anticipates rapid growth in the structural steel, fabrication and erection industry over the next few years in the Washington metropolitan area, “driven by high demand for commercial construction and infrastructure projects,” Pelham says.