Automaker Stellantis and battery company LG Energy Solution have halted construction on a portion of their $3.7-billion electric vehicle battery plant in Windsor, Ontario, over a dispute with the Canadian government.

“As of today, the Canadian government has not delivered on what was agreed to, therefore Stellantis and LG Energy Solution will begin implementing their contingency plans,” Stellantis spokesperson LouAnn Gosselin said in a statement May 15. “Effective immediately, all construction related to battery module production on the Windsor site has stopped.”

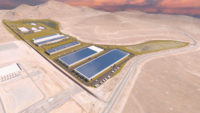

Last year, the automaker had announced its plans to build a 45-GWh-capacity plant named NextStar via a joint venture with LG. The plan calls for facilities to produce lithium-ion battery cells as well as battery modules, which is the portion of the project that was halted.

The manufacturers had picked a construction team led by a joint venture of Alberici Constructors and Barton Malow to build the 4.5-million-sq-ft plant. An Alberici representative declined to comment on the matter.

At the time it was announced, company leaders had aimed to begin production in early 2024 amid a push to increase its EV sales in the U.S. and Canada. Ontario officials praised the plan as the largest auto investment ever in the province that would, as Premier Doug Ford said in a statement then, “secure Ontario’s place as a North American hub for building the cars and batteries of the future.”

Two days before Stellantis announced the construction halt, Windsor Mayor Drew Dilkens released a statement saying that the city had helped win the plant by assembling and preparing land, and providing funding for support services. However, he added that “the entire deal is now in question due to the federal government not fulfilling commitments” even though the city and province had followed through on the deal.

Officials have not shared the exact terms of their deal with the manufacturers. The project came amid a slate of similar ones in the U.S. as automakers look to take advantage of government subsidies while pursuing emissions reduction goals. Manufacturers have sought a mix of federal, state and local government incentives when planning plants and selecting locations. In Ontario, the Toronto Star, citing unidentified sources, recently reported that Stellantis was threatening to call off the project unless the Canadian government matched the subsidies it offered Volkswagen last month. Officials offered Volkswagen subsidies worth up to $9.6 billion over 10 years for its planned $5.2-billion, 90-GWh-capacity EV battery plant in St. Thomas, Ontario.

Stellantis could instead move the battery manufacturing to a plant in Indiana, the Star reported. The company did not answer questions beyond its prepared statement.

Canadian federal government officials have not publicly addressed the construction shutdown.

Unifor, a Canadian union that represents autoworkers, is calling on the government and Stellantis to resolve the dispute, saying in a statement that government investment is necessary to attract automakers.

“The shift to electric vehicles has created a fiercely competitive environment, as evidenced by the [Inflation Reduction Act] incentives in the U.S., with jurisdictions around the world vying for these highly sought after jobs,” Lana Payna, Unifor national president, said in a statement.

Three Unifor locals work at Stellantis’ current 4.4-million-sq-ft Windsor assembly plant, which produces Chrysler vehicles. Stellantis also has an assembly plant in Brampton, Ontario, and an aluminum die-casting plant in Toronto. It plans a $2.8-billion retooling project at the two assembly plants to support production of multi-energy vehicle architecture.