Confidence Index

2Q 2024 Cost Report: Private Financing Woes Cut Confidence

Stubbornly high interest rates lessen demand for construction services

Related Link:

ENR 2024 2Q Cost Report PDF

(Subscription Required)

The results of this quarter’s Construction Industry Confidence Index survey show a dip in confidence among construction industry executives. The overall confidence index fell 11.5% to a 46 rating this quarter, from a 52 rating in Q1. The economic index is also down, falling four points to a 44 rating.

The CICI measures executive sentiment about where the current market will be in the next three to six months and over a 12-18-month period, on a 0-100 scale. A rating above 50 shows a growing market. The measure is based on responses by U.S. executives of leading general contractors, subcontractors and design firms on ENR’s top lists to surveys sent between May 13 and June 17.

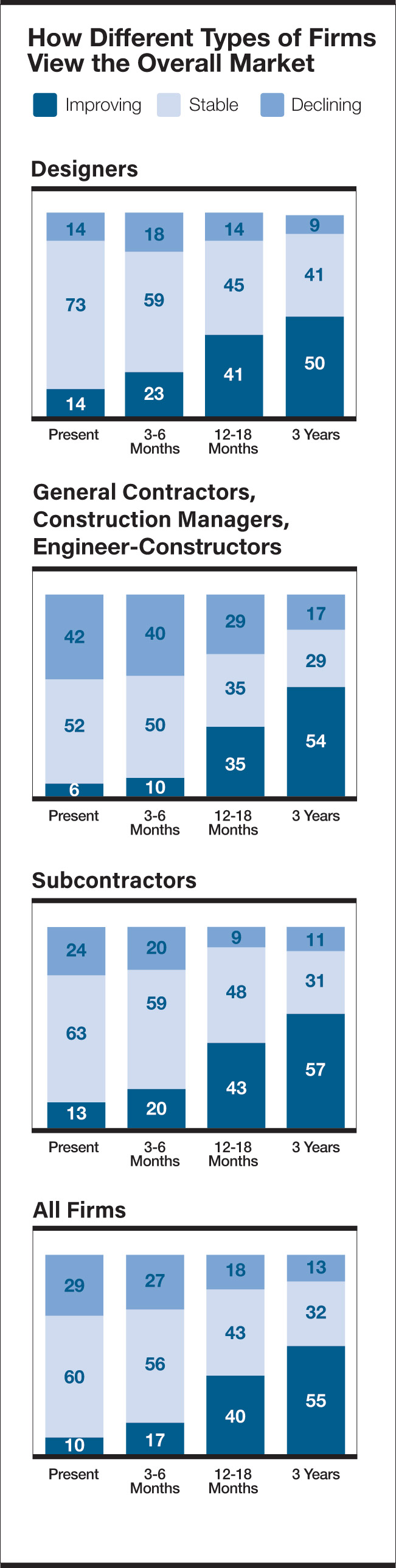

As with last quarter, GCs and CMs are more pessimistic than either designers or subcontractors; however, that gap widened significantly in Q2. GC/CM confidence comes in at a 37 confidence rating, down from 47 in Q1 for that group. Although less extreme, confidence among both designers (from a 56 rating in Q1 to 54 in Q2) and subcontractors (57 to 51) has also dropped. Over 40% of GCs and CMs see a declining market both currently and 3-6 months from now.

Confidence is highest among firms who do business in the Midwest, with a confidence rating of 49, down from 55 last quarter. Firms who work in the Far West/Pacific region are the most pessimistic this quarter, with a 40 rating, significantly down from 52 last quarter.

CFO Confidence Dips

The CICI’s results are largely mirrored by those of the Confindex survey from Princeton, N.J.-based Construction Financial Management Association (CFMA). Each quarter, CFMA polls CFOs from general and civil contractors and subcontractors on markets and business conditions. The resulting Confindex is based on four separate financial and market components, each rated on a scale of 1 to 200. A rating of 100 indicates a stable market; higher ratings indicate market growth.

Source: ENR/BNP Media

All indices that the Confindex tracks fell between Q1 and Q2 of 2024, with the exception of the “current conditions” index, which rose 2.9% to a 106 rating. The overall Confindex is down 2.8% this quarter to a 109 rating. The “business conditions” and “financial conditions” are also down, 3.7% and 0.9% respectively.

Higher interest rates and tighter credit conditions are taking their toll on a growing share of contractors, thinks Anirban Basu, CFMA advisor and CEO of Sage Policy Group. Interest rates do not appear to be coming down much, if at all, this year. “I think it is pretty clear that the Federal Reserve will reduce rates between zero and two times this year—most likely one rate cut late this year.” Basu expects several rate cuts in both 2025 and 2026.

The largest drop among the Confindex indices was in the “Year Ahead Outlook” index, which fell 7.8% to a 107 rating. This drop is reflective of a growing concern over demand for construction services, says the Sage CEO. The looming November election is another factor, likely causing owners to hold some projects.

Rising materials prices and ongoing skills shortages add to the concern, with 66.7% of ENR survey respondents reporting upward pressure on materials prices this quarter, up from 59.8% last year.

Margins appear to be thinning out. “[CFMA’s Confindex survey] indicates that the proportion of firms reporting growing profit margins is now fully offset by the proportion reporting slimmer margins,” notes Basu.

CICI respondents do report a stabilization of sorts when it comes to their clients’ ability to finance. Although 37.8% of firms say their clients’ access to financing is somewhat or much worse than it was six months ago, that number is down significantly from the 63.9% reported in Q4 2023. Basu believes that number could be buoyed by the increased flow of federal funding: “Even though private financing has become more expensive and difficult to obtain, public financing is plentiful to support industrial and infrastructure projects.”

The clock is ticking on some of that public financing, however. That likely means fewer megaprojects moving forward, given the federal subsidy component of many of those projects. “America cannot continue to spend as it has been. It is not sustainable with a national debt approaching $35 trillion, along with Social Security and Medicare insolvency,” the Sage economist explains.

Fixed Price Issues

Continued supply chain issues and ballooning input prices have caused issues for fixed-price contracts initiated just before or at the start of the pandemic. “The result has been many lawsuits involving acts of God, force majeure and similarly situated contractual language,” says Basu. Zachry Group’s May 21 Chapter 11 filing is an extreme example of the trend. “I don’t think what happened to Zachry Group is a one-off, but a function of the deal structure,” says Neil Shah, CFMA president and CEO. Shah expects more disputes on the horizon, although not as impactful to a contractor as with Zachry.