Equipment

2Q 2024 Cost Report: Stable Prices, Reasonable Supply Chains Keep Equipment Moving

Slight price dips after rises show a used market getting back to normal cycles

Related Link:

ENR 2024 2Q Cost Report PDF

(Subscription Required)

With an extended period of construction activity and no imminent signs of recession, prices for used construction equipment at resale and auction have found their level, with fewer of the fluctuations that marked recent years. And that stability may signal that the last of the COVID-19 pandemic-related supply chain disruptions could be finally working out of the system.

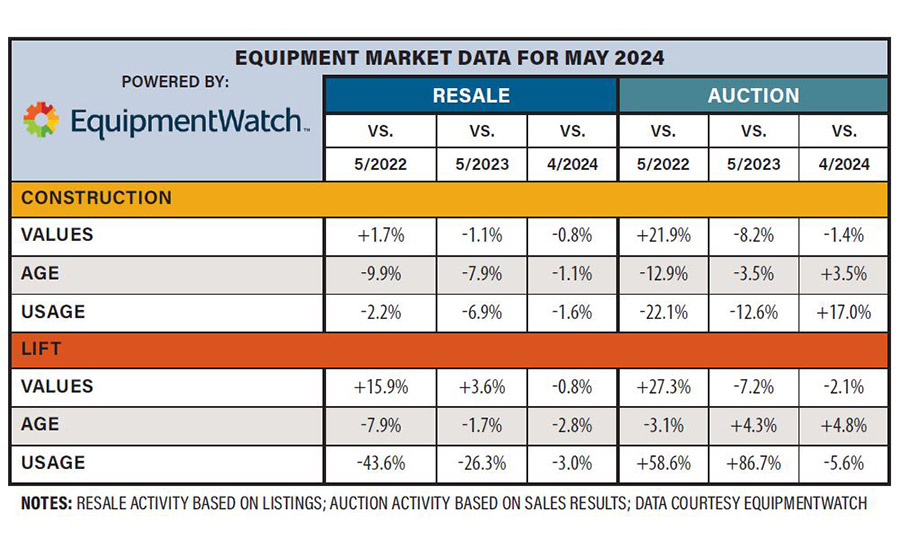

“The values we’re seeing year-over-year have been dropping the last couple of months, about a percentage point each month,” says Sam Pierce, sales engineer with market sector analyst EquipmentWatch. In its sales data, the analyst has seen resale values for used construction equipment go down 0.8% in May compared to April, and down 1.1% compared to May 2023. Prices at auction are also down 8.2% year-over-year, another sign of more reasonable cycles, says Pierce. “In the construction market it seems like values are going down after the big increases we’ve seen in previous years. It’s fairly stable, changing just a percent month-to-month.”

Original equipment manufacturers have reported strong results, but there are headwinds. Caterpillar reported $27.4 billion in construction sector sales in 2023, a 9% increase over 2022, in the company’s annual report released June 14. Caterpillar CEO Jim Umpleby noted in his remarks to shareholders at the annual meeting that the company is seeing profits on new equipment despite the ongoing energy transition to battery-powered and lower-emission equipment. “We are developing an expanded portfolio of fully electric, fuel-flexible and increasingly fuel-efficient products to help customers achieve their climate-related objectives,” he said.

But it’s not all rosy for the OEMs. Japan-based Komatsu, the second-largest construction equipment OEM after Caterpillar, reported largely flat sales in its annual report earlier this spring. While the manufacturer expects to see a growth in sales in North America over fiscal year 2024, unfavorable exchange rates for the Japanese yen and fixed production costs will restrain their supply and hurt profits.

John Deere reported a 7% year-over-year drop in sales for its construction and forestry division in the second quarter for 2024, which translated into a 20% drop in operational profit year-over-year. But that sector outperformed Deere’s agricultural equipment sales, and it cited construction as a bright spot. “Thanks to [our team] we continue to demonstrate structurally higher performance levels across business cycles and are benefiting from stability in construction end markets amid declining agricultural and turf demand,” Deere CEO and Chairman John C. May said in the company’s second quarter results announcement.

Construction serving as a backstop for the wider equipment sector is surprising news after some shaky years, Pierce notes. “Compared to the agricultural and lift categories, construction is more stable. Both of those have seen year-over-year increases in [used equipment] prices. Agriculture is up 5% and lift is 3.6% up over last year.”

And after the last few years, stability is welcome. “Two years ago the [used equipment] numbers were all over the place, it was wild,” recalls Pierce. “Now we’re seeing what I would expect to see: these more normal trends—not these huge swings of people trying to source or liquidate equipment—that’s a pretty good sign.”

.jpg?height=200&t=1640294757&width=200)