Related Link:

ENR 2024 3Q Cost Report PDF

(Subscription Required)

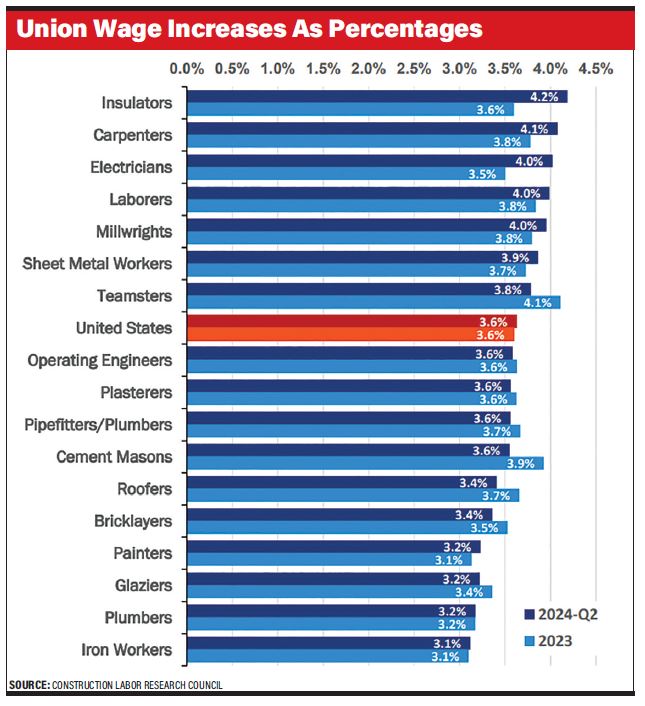

As many craftworkers grapple with the lingering effects of recent high inflation rates, employers continue to offer historically high wage increases. Union settlements and open shop wages continue to surge, not only to keep current workers happy but to help combat labor shortages.

At the end of 2023, first-year increases in union settlements reached 4.7%, up from around 3% in previous years, according to data from the Construction Labor Research Council. By the end of the second quarter of this year, first-year increases had settled back slightly to 4.6% and subsequent settlements suggest that this year’s settlements could land in that same range.

Carey Peters, executive director of CLRC, notes that 76% of all settlements occur between May and July, providing a solid indicator of overall settlements for the year. “For the third quarter, we expect to be probably within one or two tenths of that 4.6% figure,” he adds.

Peters says much of the current level of increases is a continued “lag effect” from the high inflation rates in 2022. The length of settlements averages around three years, meaning that many union members have been working under settlements made in 2021. While a large percent of settlements last year was concentrated around 4.5%, CLRC data shows a larger disparity in the range. In the first half of the year, 23% of first-year settlements were 6% or higher. In 2023, only 5% of settlements exceeded 6%.

“Two or three years ago, a 6% increase was almost unheard of,” Peters says. “Now, they need to make up some ground and the bargaining parties realize that’s what they have to do.”

Some of the largest increases have been in the southern states, which in CLRC’s data includes Alabama, Arkansas, Florida, Georgia, Kentucky, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas and Virginia. Last year, first-year increases in that region hit 5.1%. Through the second quarter of this year, the average was up to 6.1%. Notably, in terms of dollar amount, the south region settlements are around the middle of the range, close to the national average of $2.94.

The northeast—which includes Connecticut, District of Columbia, Delaware, Maine, Maryland, Massachusetts, New Jersey, New Hampshire, New York, Pennsylvania, Rhode Island and Vermont—remains at the lowest level of increases, tallying 3.8% in 2023 and 3.9% through the second quarter of this year.

Among specific trades, operating engineers, pipefitters/plumbers, laborers, sheet metal workers, roofers, electricians and insulators all reached agreements in the first half of this year with first-year increases at or above 5%. Iron workers and plasters were at the lowest end of the scale, averaging under 3.5%.

The current economic pressures have made for difficult negotiations this year. In southern Nevada, the sheet metal workers reached a tentative four-year agreement with employer groups in June, but it was voted down by union membership and went to arbitration. Meanwhile, plumbers and pipefitters in the state are taking negotiations with employers down to the wire, as the current agreement is set to expire at the end of September. No agreement was in place at press time.

Mandi Wilkins, executive vice president of Mechanical Contractors Association of Las Vegas, says that while the area is seeing a lull in construction and there isn’t a labor shortage, union members remain acutely concerned about inflationary pressures. “At this point, I think it’s really all about the check,” she says. “Fringe benefits and the trust funds for [the plumbers and pipefitters] are well funded and well managed.”

Wilkins says employers are trying to find ways to ease worker concerns by boosting wages through a higher percentage first-year increase, followed by slightly lower-percentage increases in the remaining years. “I think from the management side, people are trying to bite the bullet at the front end [of an agreement]. That helps make up for some inflationary pain.”

Merit shop workers also continue to see strong bumps in pay. Last year, firms that offered wage increases reported an average increase of 4.4% nationally, according to the 2024 Merit Shop Wage and Benefit Survey, conducted by PAS. In the survey, employers forecasted increases of 4.1% this year. However, Jeff Robinson, the firm’s president, says that is likely a conservative estimate and should come in closer to 4.4%.

“I’m hesitant to even forecast where things are headed next year, but at this point I think it’s safe to say that 2025 will look at lot like 2024,” he adds.

Robinson says that while short-term changes in cost of living rarely have a strong impact on wages, the current inflationary pressures can’t be ignored. Robinson says data shows that wage increases since 2021 have not kept pace with inflation and are significantly reducing workers’ “purchasing power.” Based on 2,080 work-hours per year, purchasing power since 2021 for merit shop workers is down $3,660 for pipefitters; $3,120 down for carpenters and $3,040 down for heavy equipment operators.

Labor shortages remain a critical concern. In August, construction unemployment hit 3.2%, according to Bureau of Labor Statistics data. That is the lowest August rate in the 25-year history of the data, according to an Associated General Contractors of America analysis.

“Something’s got to change if unemployment stays that low [next summer],” he says. “At some point, it’s going to drive wages up. There just are not enough people to do the work.”